Carbon Clean 200 list leaded by electric vehicles, natural food and green energy producers

You Sow and Corporate Knights have released their seventh update of the Carbon Clean 200, a list of the 200 publicly traded companies that are leading the way among their global peers to a clean energy future.

Key findings include:

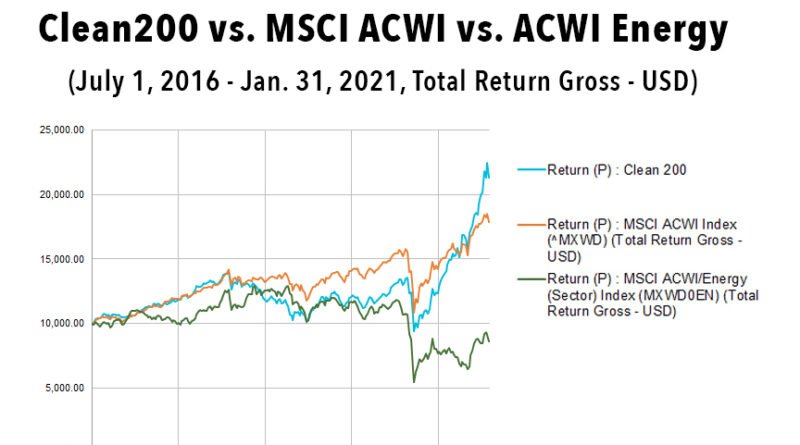

Clean200 companies generated a total return of 113.41% beating their not so clean peers. $10,000 invested in the Clean200 on July 1, 2016 would have grown to $21,340 by Jan. 31, 2021, versus $17,867 for the MSCI ACWI broad market benchmark and $8,617 for the MSCI ACWI Energy benchmark for fossil fuel companies.

10 companies which contributed the most to the Clean200’s outperformance over the past year are split between China and the U.S. and include electric vehicles, natural food, and green energy themes.

The top 10 companies on the list by revenue include German industrial company Siemens for its large green infrastructure portfolio, and German SAP SE for its green-powered software services.

Germany has 8 companies in Clean200, Sweden has 7 companies and Denmark has 5.Danish Vestas Wind Systems A/S is 12th in the list and represents industrials sector. The first Swedish company appears in 37 place and it is Telefonaktiebolaget LM Ericsson from the Information Technology sector.

“In 2016 we created the Clean200 in response to investors saying, ‘if we divest fossil fuels there is nothing to invest in.’ The Clean200 has demonstrated consistently that the clean energy future is the clean energy present,” said Andrew Behar, CEO of As You Sow and report co-author.

“While tech companies like Amazon and Zoom have had a good run through this pandemic period, the broad-based trend of outperformance has been dominated by companies providing sustainable solutions, signaling the market’s confidence in their mojo to take our economy forward post-pandemic,” said Toby Heaps, CEO of Corporate Knights and report co-author.

The Clean200 utilizes Corporate Knights Clean Revenue database which tracks the percent of revenue companies earn from clean economy themes including energy efficiency; green energy; electric vehicles; banks financing low-carbon solutions; real estate companies focused on low-carbon buildings; forestry companies protecting carbon sinks; responsible miners of critical materials for the low-carbon economy; food and apparel companies with products primarily made of raw materials with a significantly lower carbon footprint; and Information and Communications Technology (ICT) companies that are leading the way on renewable energy while also being best-in-sector according to currently accepted privacy benchmarks.

The list excludes companies that are flagged on As You Sow’s Invest Your Values suite of mutual fund transparency tools that identifies companies involved in fossil fuels, deforestation, weapons, gender inequality, tobacco, and the prison industrial complex.

“We will continue to track and share the emergence of this economic powerhouse,” Behar continued. “There is now clear financial evidence showing a broad spectrum of companies and market forces making the economic transformation, which is our greatest hope in controlling climate change.”